Hydrogen can transform Net Energy Metering in the State of California

In California, Net Energy Metering (NEM) allows Commercial and Industrial (C&I) customers who generate wind or solar power electricity to sell their excess electricity back into the electric grid and, in turn, receive billing credits. The idea is for these credits to provide energy savings and more control of electricity bills.

Currently, California is under its second iteration of NEM, or NEM 2.0, which expands the scope to consider time-of-use rates, interconnections fees, and non-bypassable charges.

However, NEM 3.0 is on the horizon, and the California Public Utilities Commission (CPUC) is working on more modifications and reduced metering credits.

The NEM 3.0 proposal plans to modify these three key areas:

Solar energy export value

Required rates for solar customers

Solar fees

A significant takeaway from the recent NEM 3.0 discussion is that export metering credits would be based on 'avoided cost,' which factor in the time of use when a C&I customer exports electricity to the electric grid.

It would also include a proposed "solar fee," which would all be settled monthly rather than annually as it currently is. Once this modification is implemented, it is predicted that solar projects could see the value of net metering credits increase by up to 75%.

However, utilities indicate that NEM 3.0 could incentivize customers to add storage to their home solar energy systems to avoid higher costs.

Their proposal states that NEM 3.0 provides a storage incentive through non-tiered cost-based Time-Of-Use (TOU) rates and ensures customers pay for costs incurred to serve them by directly charging them. In practice, customers who add a battery storage system can avoid the increased rates of pulling power from the grid in the evening when TOU rates are higher.

The case for green electrolytic hydrogen storage

The key to this incentive for customers is capitalizing on the potential for storage by utilizing a longer-lasting solution than traditional batteries, namely launching green electrolytic hydrogen storage systems.

These green electrolytic hydrogen storage systems provide a broad range of energy services, including demand charge reduction, critical backup power, and excess solar/wind energy storage for future conversion back to grid electricity.

Hydrogen energy storage systems also represent an opportunity to increase the flexibility and resiliency of the sustainable energy supply system. These green electrolytic hydrogen storage systems could also potentially reduce overall energy costs and increase the practical utilization of renewable energy.

The advantages of green electrolytic hydrogen storage

Green electric hydrogen solutions have distinct advantages over batteries, including:

Scalability: Hydrogen-based systems are scalable from kW to mW scale, allowing for multiple use cases for behind-the-meter customers or utility-scale applications.

Flexibility: Renewable hydrogen is produced with excess solar and wind energy. Unlike other technologies, hydrogen systems can store MWh of power in pressurized vessels or solid metal hybrids.

Emissions: Renewable-based hydrogen allows for a genuinely zero-emission solution. Since hydrogen does not require the grid to function, it is more scalable and flexible as it does not require the grid to work.

Environment: Approximately 95% of the precious metal platinum used for the Membrane Electrode Assembly (MEA) is recycled and reused in refurbished and new fuel cells, making it much more environmentally friendly.

Performance: Fuel cells have a proven track record for performance. For example, fuel cells can achieve over 30,000 hours in the automotive industry.

Long Duration: Hydrogen storage tanks can operate from 8-24 hours or longer if needed.

For C&I customers, the business case for significant savings includes:

Improved time-of-use bill management due to shifting from low-value solar to high-value peak power

Demand charge reduction via minimized demand loads and reduced costs

Access to reliable backup power that is zero emission peak power.

Interconnection is a significant barrier due to distribution constraints. Green hydrogen and fuel cells can avoid deferrals and unlock GWs of solar/wind.

Developing the business case for green hydrogen storage

The business case for green hydrogen involves weighing and making a technical and economic assessment Dash Clean Energy's HydroDATUM supports this analysis by:

Provide site location and solar system size.

Input customer information (load data, energy charge data, demand charges)

Electrolyzer and Fuel Cell sizing data

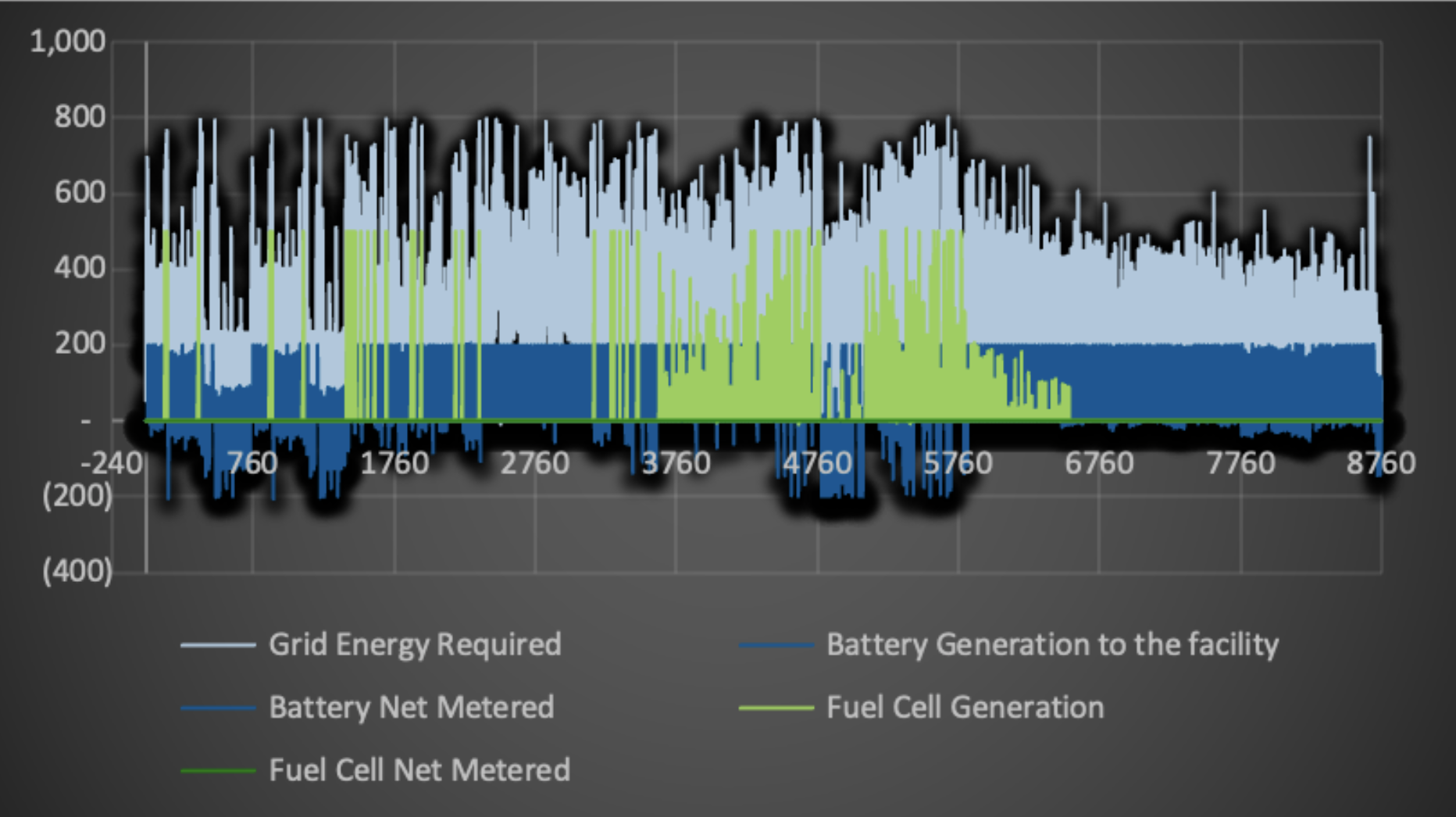

HydroDATUM performs hourly "8760" modeling of your site and provides technical and economic assessments.

Let's look at an example scenario of the HydroDATUM in action.

HydroDATUM business case scenario

Below is an example scenario of how the economics stack up when using HydroDATUM as a C&I Standalone Customer within Southern California Edison Service Territory.

For this example, we use 0.5MW/ 24MWh storage paired with 1MW of Solar PV.

Context:

The project utilizes an AC-coupled battery to support instantaneous loads.

The electrolyzer is powered exclusively by the coupled solar PV system.

The project is designed to provide peak power and send excess energy to the grid during peak hours.

Additional revenue is captured through participation in Demand Response and local Self-Generation Incentive Program ("SGIP") programs.

Market Conditions:

The electrolyzer and Fuel Cell are sized independently for the customer.

SCE C&I Time-of-Use General Service - Large, TOU-8-E

SGIP funding as of September 2022 for fuel cell projects is $2,000/kW, and $33 million is available

40% ITC for Fuel Cell, Electrolyzer, Storage, System

Results:

5-Year Payback

Learn more about our HydroDATUM software solution.